Cost Of Living Crisis: Self-Sponsored Students Narrate Struggle

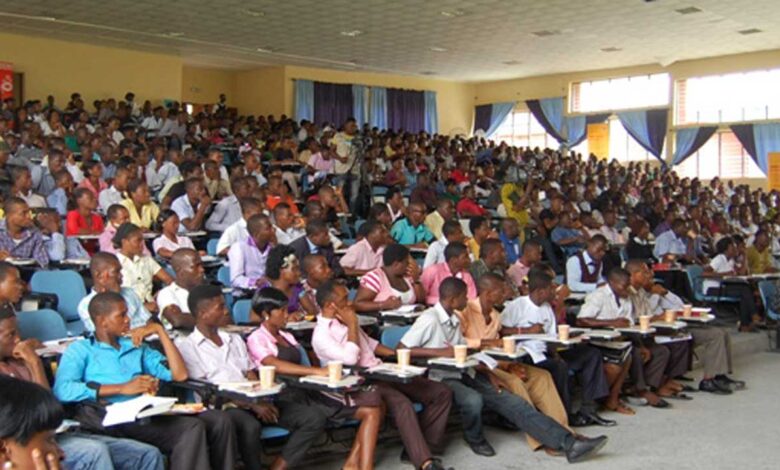

Nigerian universities began to announce an increment in their fees in June, following an increase in fuel prices and an automatic rise in cost of living. However, the development is having negative effects on students sponsoring themselves through school.

At the beginning of her academic journey at the Obafemi Awolowo University (OAU) in South West Nigeria, Oluwabusolami Salami nurtured the dream to not just pursue an academic degree in law but also stand out to become one of the best among others.

She never had to worry about finances because the income of her father, a Nigerian Customs Service officer, was enough to cater for her needs alongside three other siblings. There also wasn’t a cost of living crisi at the time.

Her mother, a teacher, was also supporting her at the time.

“Years back in secondary school, things were smooth. My father would provide me with everything I wanted. I had so much money that I would not even know what to use it for,” she told HumAngle.

After multiple attempts to secure admission failed, she decided to run a pre-degree programme.

This programme normally runs for one academic session to prepare students for the Unified Tertiary Matriculation Examination (UTME) examination and screening towards admission into the first year of various degree programmes.

“The fact that I kept writing UTME Jamb multiple times taught me that there was no way I could keep depending on my parents financially, so I started pondering on what I could do to make money while still trying to gain admission into the university.

“By the time I eventually gained admission into pre-degree, things were becoming bad as a result of the rising cost of living. I was solely dependent on my parents, and they also had my other siblings to fend for. It was very hard for them.”

Still, they struggled to do their best for the children.

“During that period, I was so eager to get something that would bring money but nothing was forthcoming because I didn’t have any capital to start any business for myself.

“It was towards the end of my first year in school that I was introduced to ghostwriting after asking different people about what I could do to fetch some stipend to sustain myself,” she explained.

A ghostwriter is a freelance writer who writes blog posts, fiction and nonfiction, memoirs and many more for someone else.

Many Nigerian university students do this for clients based on a fixed price in a bid to make more money or be independent in schools.

Life as a ‘working-class’ student

When Oluwabusolami became a sophomore at OAU, her parents retired from work so their finances worsened.

She had to take her part-time job as a ghostwriter more seriously.

“I worked tirelessly to get gigs, even third parties. I went from supporting myself alone to supporting my whole family because I couldn’t just watch my family struggle and do nothing.”

Although she was not pressured by her parents to provide for the family, there’s a need for her to bridge the financial gap that her parents’ retirement had caused.

Since her parents’ pension can no longer sustain the family, Oluwabusolami prematurely takes the responsibility of paying her school fees while she also ensures that her siblings in lower school are being cared for.

“I have to worry about paying the school fees of my siblings. There was a day I was worried about my youngest sister missing her midterm test because I hadn’t paid her school fees.

The part-time job would later take a huge toll on her education as she sometimes has to choose between attending classes and doing ghostwriting to make money.

“There is a clear difference in the academic situation of my first year and now. I never missed classes, and my grades were good. However, at this point, I have given up on good grades. I just want to be done with school first, there will be other opportunities to make up for my grades.”

She’s also missing once-in-a-lifetime university experiences including internship opportunities and extracurricular activities.

Fluctuating income

Oluwabusolami’s income has never been fixed as it depends on the number of articles she’s able to write monthly.

While there are months when she earns between ₦50,000 ($64.64) and ₦200,000 ($258.56), she hardly earns anything in some months.

“I have decided to go into academic pieces that used to be extremely challenging because of the unrealistic deadlines and requirements I was given. But I don’t have a choice because I have bills to settle.

“There are times I would cry, and nobody would know, sometimes I would feel so tired and other times, I just tend to snap unnecessarily at others, due to the frustration I feel,” said Oluwabusolami.

Effects of inflation

Now in her final year, inflation caused by the removal of the fuel subsidy has hit her very hard.

“Since the removal of the fuel subsidy, I can only say that my family and I are living by faith, because things have clearly and sadly become worse. My financial state is currently a mess because I have incurred a lot of debt.”

Many institutions have increased their fees by 100 to 200 per cent, a development that may likely force some indigent students out of school.

The universities justified the hike on poor government funding of tertiary education and rising inflation in the country, which according to the National Bureau of Statistics (NBS) shot up to 22.4 per cent, the highest in 17 years.

“I am a strong hustler. I will keep pushing until I’m done with school. I have never thought of dropping out of school. I also don’t think there is any point in dropping out since I am in my final year. I just need to be done with school first, before I have time for myself.”

Skipping classes

Ajayi David is another student affected by the worsening economy.

In 2021, David decided to lessen the financial burden of his parents by partly sponsoring himself through school.

While his parents pay his school fees and house rent, he provides himself with feeding, clothing, and other related expenses.

He was doing this as a script and content writer.

“I noticed Nigeria’s worsening economic situation and what it could mean to my parents to take care of my siblings and still earn the same income they had earned over the years. So, I told them not to worry about me.”

Two years later, the economy has become increasingly challenging.

“It is currently very hard to have three square meals as a student. I just manage resources in every possible way that I can,” he told HumAngle.

“I have devised a way of adjusting. For instance, since the cost of transportation from my house to the school has doubled, I decided to reduce the number of times I go to school for classes,” the final-year student explained.

David, however, said he makes sure he collects notes from his friends anytime he misses classes.

The cost of living crisis is translating into poorer education for students like David and Oluwabusolami because they can either not afford to make the trip to school to take classes every day, or they must take time to work to pay their tuition rather than study. This can, in turn, reduce their prospects when they graduate.

Support Our Journalism

There are millions of ordinary people affected by conflict in Africa whose stories are missing in the mainstream media. HumAngle is determined to tell those challenging and under-reported stories, hoping that the people impacted by these conflicts will find the safety and security they deserve.

To ensure that we continue to provide public service coverage, we have a small favour to ask you. We want you to be part of our journalistic endeavour by contributing a token to us.

Your donation will further promote a robust, free, and independent media.

Donate HereStay Closer To The Stories That Matter