Insecurity Threatens POS Operators, Excludes Sokoto Residents From Financial Services

With the rising level of insecurity in the country, point-of-sale machine operators in Northwest Nigeria are having their own share of attacks and the development is excluding many residents from financial inclusion.

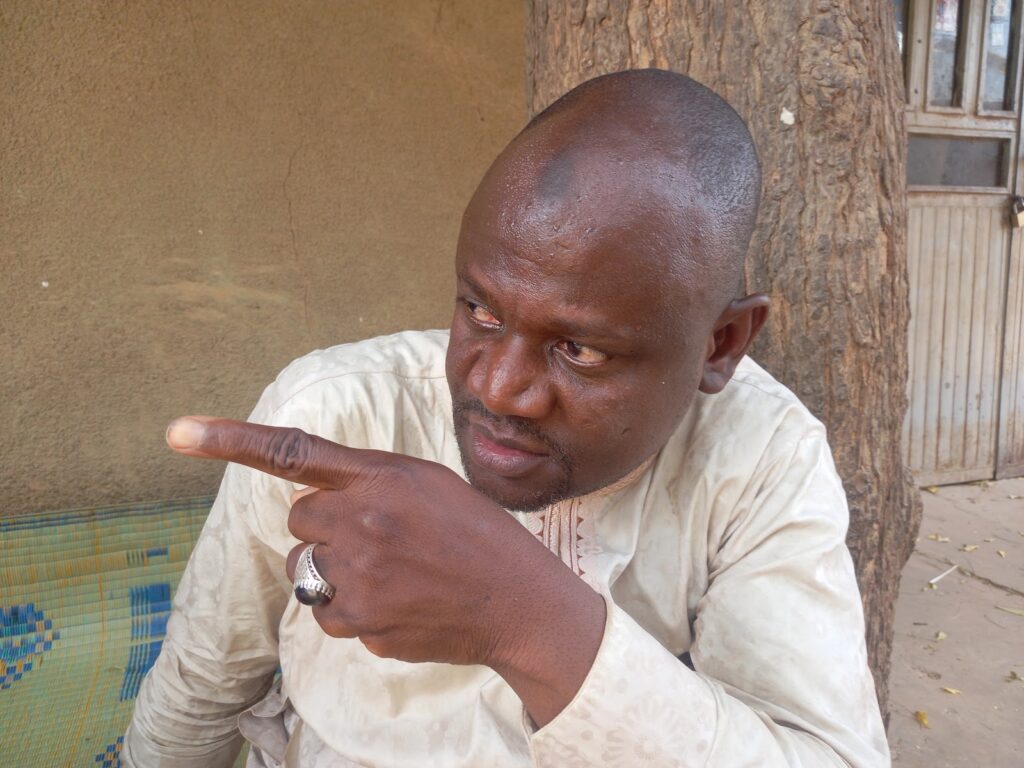

Abass Muhammed, 32, became a Point of Sale (POS) agent after losing his teaching job during the COVID-19 pandemic lockdown in 2020. He had borrowed money from friends and family to launch his business with the aim of attending to the financial needs of residents of the Goronyo Local Government Area of Sokoto State, Northwest Nigeria.

Most bank account owners in the community prefer to pay a token of ₦200 to deposit or withdraw money from their accounts within a few minutes, instead of spending more money and time going to far-away banks for the same purpose.

Like Muhammed, many other POS operators joined in making life easy for residents and business owners by setting up their operations at markets and bus parks, handling deposits and withdrawals for bank customers while taking the burden of having to face large crowds at the banking halls.

All was going well for Muhammed until Sept. 17 when bandits robbed him and kidnapped his wife and brother.

Goronyo

Goronyo is one of at least seven areas in Sokoto under frequent attacks by terror groups, known locally as bandits, with the crisis leading to huge losses of lives and property. Over 42,000 people have reportedly been displaced as a result of repeated terror attacks in the state. Those who could not flee have joined vigilante groups to protect their villages.

Unfortunately, vigilante heads and community leaders are not spared as the terrorists now impose multi-million naira protection levies on residents in some of the communities.

It was about to rain when Muhammed closed his shop at the Sabon Gari area of Goronyo around 9:30 p.m. on Sept. 17, 2021. As soon as a bolt of lightning tore across the sky and claps of thunder followed, he jumped on his motorcycle and drove home.

He told our reporter that the rain that poured that night soaked his clothes and the unpaved paths to his house were awash with mud. The rain did stop drizzling until he got home.

The attack

Barely one hour after getting home, the rain had subsided and it was time for Muhammed to sleep. He kept his bag in his wardrobe as usual and proceeded to bed. Muhammed was struggling to catch a dose of sleep when he heard the sound of armed men scaling the fence into his compound.

Before he could make any attempt to hide, six men armed with guns and machetes had broken into his sitting-room already, asking him to give them all the cash in his house.

“They put guns on my head and asked where I kept my money. I tried explaining to them that the money was borrowed from different friends and family members to run the POS business but they threatened to kill me,” he said. “I was forced to lead them to my room, they took over ₦3.2 million from me and went away with my POS machine.”

He told our reporter that his elder brother, Annas, and his wife, Zarau, were subsequently kidnapped by the bandits despite stealing his money and other valuables from him.

“They took my wife and elder brother away that same night. They called the following morning, asking me to pay ₦5 million ransom for their release. They held them for seven days and threatened to kill them but I kept begging,” he explained.

When the bandits realised that Muhammed could not get the ransom a week after, they settled for ₦300,000 and subsequently released his family members. To continue his business, he now borrows money from people to carry out his mobile banking services and gives returns to the lenders at night.

He has also vacated his personal house to rent an apartment close to the office.

POS agents vacate Goronyo

Unlike Muhammed who continues to run his business activities after his encounter with terrorists, many other POS agents have left the community because of fear of being attacked. One of them is Sulieman Adamu.

“He left the community after I was robbed. As the level of insecurity deteriorated, he quit the job and has since gone to Sokoto capital alongside his family members. I don’t know where he is currently operating. I am here because there are some soldiers who are still trying to ensure our safety. If not, I would have run away as well,” Muhammed said.

When contacted on why he left Goronyo, Adamu told this reporter that his life is worth more than rendering financial service to people in an area where lives and properties are threatened by terrorists.

“The challenge is beyond what you think. I left Goronyo following repeated attacks by bandits. I used to be in the markets to help people withdraw and deposit money on market days. I concluded plans to leave the place after bandits opened fire on those carrying out their weekly market. I have never looked back since the day I left,” he said during a telephone interview with our reporter.

Suraju Umar, another agent who claimed the insecurity in the community has affected him, said, “People no longer come to Goronyo to run businesses because the kara is locked.”

Residents excluded from financial service

Following the absence of banks and the shut down of most POS options in Goronyo, residents are denied financial services as many told our reporter they now keep their monies at home.

“We usually withdraw money through POS, make deposits, pay electricity bills, and other things but that has really reduced now because most of the POS operators stopped working due to insecurity,” said Zainab Aliyu, a petty trader in the community.

In addition, one of the police officers ensuring peace in the community, Ismail Muhammed, said the “security challenge in this part of the state has really affected banking activities. There is no bank and with POS shutting down, many residents here are excluded from financial services.”

“There are times when people gather their money for me to help them send to their children who are in school anytime I go to Sokoto capital. The activities of the bandits are overwhelming and only God can save Nigeria. No banks and POS operations aiding financial services are dying.”

Adding to this, Suleman Zeyanu, secretary of the security committee in Goronyo, said, “As our people continue to face banditry attacks, many have lost their livelihood. POS agents are running for their lives and residents are denied financial services. No bank has its branch here because they are scared. We can only pray for a safe country where protection of lives and properties would be guaranteed.”

Nigeria’s effort to achieve financial inclusion

Financial inclusion means that people have access to basic financial services. The Central Bank of Nigeria (CBN) introduced the POS system and agent banking in 2013 to achieve financial inclusion and develop a cashless economy.

One of the conditions people must meet to become agents is that the person applying must have a current account being used to run a profitable business, and that holds a minimum of ₦50,000. They make profits from the charges on money withdrawn or deposited.

Meanwhile, the Deputy Governor and Chair of the Financial Inclusion Technical Committee of the CBN, Aishah Ahmad, said in June 2021 that women, rural dwellers, and citizens in the northern area were still excluded from financial inclusion in the country.

In Aug. 2021, the Senate Committee on Banking and Other Financial Institutions urged state governments particularly in the northwest zone of the country to ensure financial inclusion for poor citizens. The lawmakers said over 70 per cent of adults in the region were financially excluded.

Data

The banking industry in Nigeria has evolved to a level where consumers can now execute transactions at their comfort. As simple as this may seem, Nigeria fell below its targets for 2020 which is to have 80 per cent of its adults financially included.

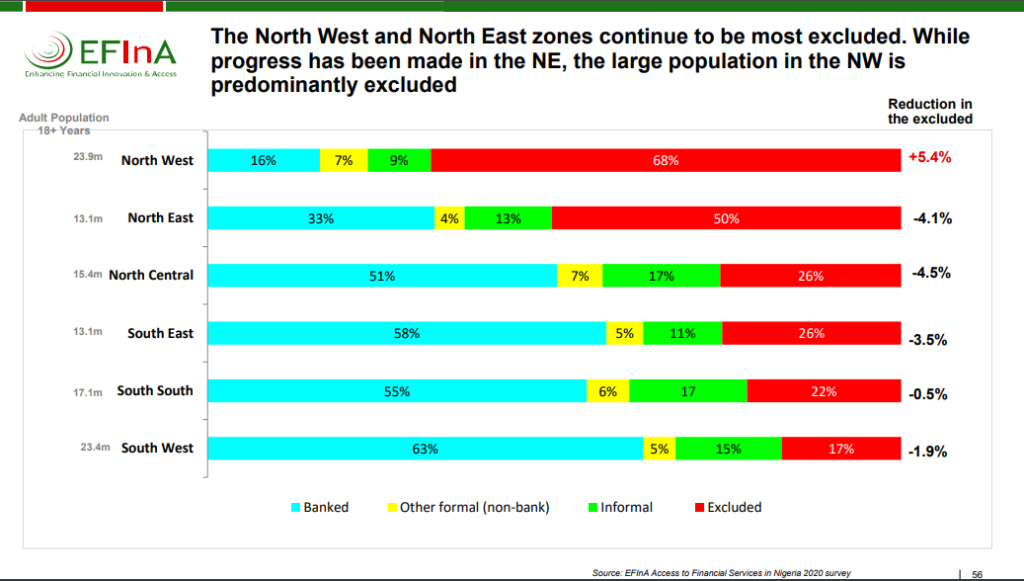

Recent statistics from the EFInA access to financial services in Nigeria showed that 38.1 million of the country’s 106 million adults (18 years and above) or 36 per cent of Nigerian adults remain completely financially excluded.

The challenge is more prevalent in rural areas because banking services are not getting to the communities, especially those facing repeated terror attacks in the northern region of the country. A breakdown of the data showed that regional differences in financial access persist, with troubling regression in the Northwest.

According to the data, 68 per cent of the adults in the Northwest are predominantly excluded.

This is because many residents in the region are residing in communities with no financial access points (FAPs). These FAPs include banks, ATMs, and Microfinance institutions.

Compared to other countries in Africa, Nigeria has the highest proportion of financially excluded adults. Rwanda in 2020 reported a 36 per cent banked population but fewer excluded adults at 7 per cent. With a banked population above 40 per cent, Kenya has about 83 per cent of its adult population financially included leaving only about 17 per cent out of the financial system.

Financial expert weighs in

Reacting to our reporter’s findings, Ayodeji Ajao, a financial expert with Economic Reality Group, said insecurity is affecting every aspect of Nigeria’s economic life.

“The activities of bandits in the northwest show that nobody is safe in most rural communities and financial inclusion cannot operate in isolation. While banks do not want to set up their branches in places that pose risks to their staff, POS operators are targeted.

“Nigeria is a troubled nation and no financial inclusion target can be met except we get rid of the problems affecting the country. Financial inclusion figures will continue to be low because people are not at peace. I’m sure that all that will be required to do is sensitisation of people if everything is normal and the operating environment is good.”

She argued that the government, setting financial inclusion targets must ensure that there is peace and stability for other economic parameters to take shape.

Support Our Journalism

There are millions of ordinary people affected by conflict in Africa whose stories are missing in the mainstream media. HumAngle is determined to tell those challenging and under-reported stories, hoping that the people impacted by these conflicts will find the safety and security they deserve.

To ensure that we continue to provide public service coverage, we have a small favour to ask you. We want you to be part of our journalistic endeavour by contributing a token to us.

Your donation will further promote a robust, free, and independent media.

Donate HereStay Closer To The Stories That Matter